Fascination About Paul B Insurance Medicare Supplement Agent Huntington

Wiki Article

Paul B Insurance Medicare Part D Huntington Things To Know Before You Get This

Table of ContentsSome Known Facts About Paul B Insurance Medicare Health Advantage Huntington.Our Paul B Insurance Local Medicare Agent Huntington IdeasFascination About Paul B Insurance Medicare Part D HuntingtonFascination About Paul B Insurance Medicare Agent HuntingtonThe 20-Second Trick For Paul B Insurance Medicare Advantage Plans HuntingtonHow Paul B Insurance Medicare Agent Huntington can Save You Time, Stress, and Money.The 2-Minute Rule for Paul B Insurance Medicare Agency Huntington

Everyone with medical insurance must have a doctor who will certainly manage their healthcare. That indicates you will need to find a doctor-- likewise called your health care doctor-- who is taking on brand-new clients. If you have children, you will need to locate a pediatrician or household method physician for their care. When you have actually located a physician that will certainly take

you as a person, established a consultation for your first check-up. If you or a family members member gets ill yet it's not an emergency, call your family physician or pediatrician and make a visit. If your doctor can not fit you in, you might go to an immediate treatment facility. For circumstances, you can go there to get stitches for a bad cut or to be inspected if you have a high

fever. Call your insurance provider initially to make sure it will spend for treatment there. Your insurance policy might also cover treatment at a retail-based clinic like the ones at huge stores with drug stores.:max_bytes(150000):strip_icc()/how-much-does-health-insurance-cost-4774184_V2-f7ab6efc9c5042d3aedcbc0ddfc6252f.png)

For instance, if you're having a cardiovascular disease or are bleeding badly from a wound, telephone call 911 or most likely to the emergency room. You can constantly obtain treatment at an emergency clinic, whatever sort of insurance coverage you have-- yet it might cost you greater than if you went to a physician's office or an urgent care center for treatment.

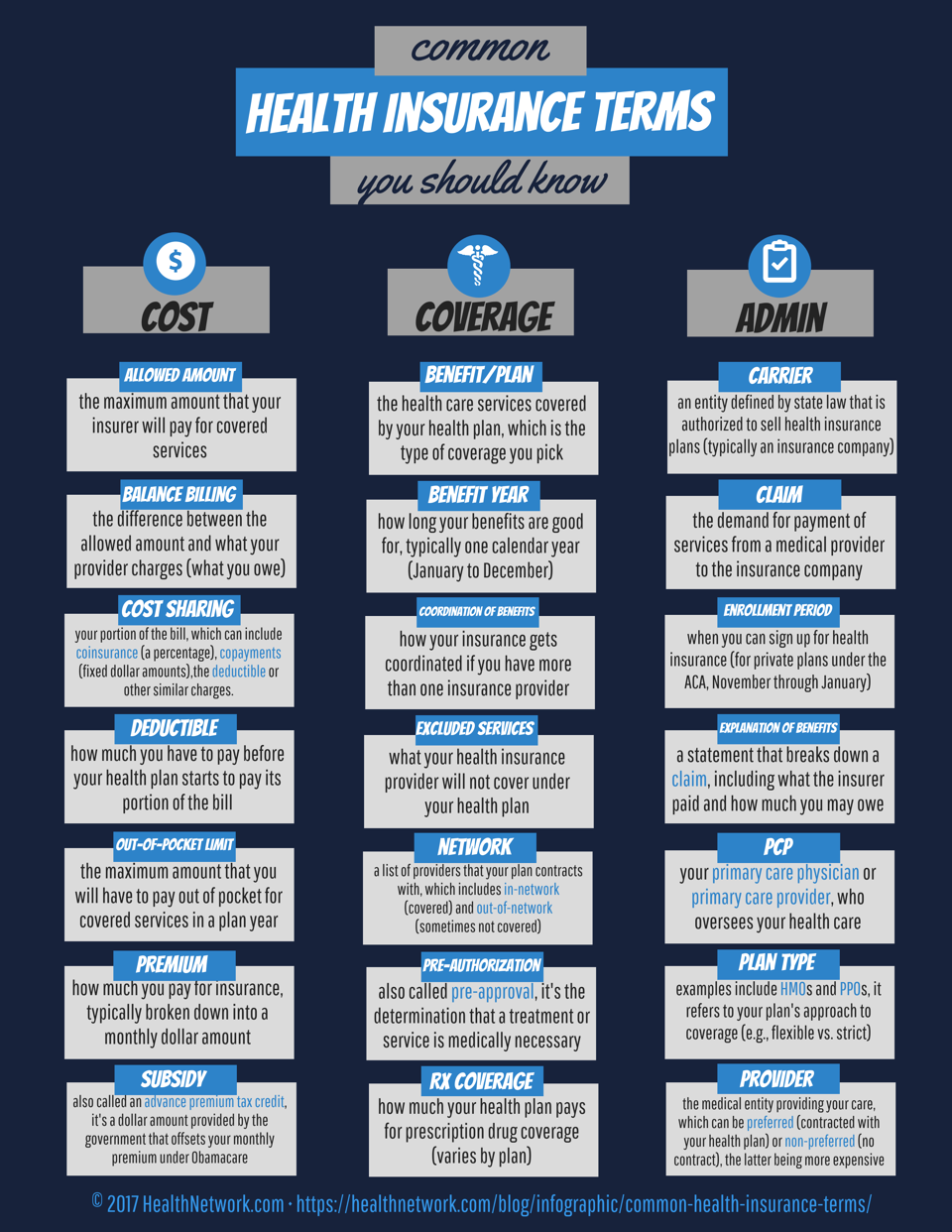

Paying for wellness treatment includes two sorts of expenses. You pay a monthly costs and also your cost-sharing-- the portion of each treatment or service that is your duty. The amount of money you pay varies from strategy to plan. The majority of health insurance plan have a buck amount called the deductible.

See This Report about Paul B Insurance Medicare Agent Huntington

For instance, you might need to pay $1,000 in medical expenses before your insurance policy kicks in. Plans might cover some solutions without requiring you to reach the insurance deductible, such as a specific number of sick gos to as well as well check outs. As soon as you've fulfilled your deductible, the insurance provider will certainly start to cooperate the price of your medical costs.You might have a $10 copay every time you see your primary care doctor or $30 every time you see a specialist. This quantity remains the same despite exactly how a lot the browse through expenses. Coinsurance is the portion of the price that you are accountable for. Claim your coinsurance is 20%.

The insurance coverage business pays the remainder. A lot of wellness plans are required to cover preventative treatment with no cost-sharing. This suggests also if you have not fulfill your yearly deductible, you can still get precautionary treatment services absolutely free. Preventive care advantages include immunizations, some cancer screenings, cholesterol testing, and also counseling to improve your diet or stop cigarette smoking.

Getting The Paul B Insurance Medicare Advantage Agent Huntington To Work

You can locate a checklist of all the cost-free preventive care services right here. Some strategies that existed before 2010 that have not considerably transformed-- known as grandfathered strategies-- as well as temporary health strategies those that offer insurance coverage for less than a year-- do not need to offer cost-free precautionary solutions.For instance, kemper auto insurance if you're having a cardiovascular disease or are hemorrhaging badly from an injury, phone call 911 or go to the emergency room. You can always obtain treatment at an emergency clinic, regardless of what type of insurance you have-- however it may cost you even more than if you went to a doctor's office or an immediate treatment clinic for therapy.

Paying for healthcare includes 2 kinds of prices. You pay a regular monthly costs and also your cost-sharing-- the section of each treatment or service that is your duty. The amount of money you pay varies from plan to plan. Most health and wellness strategies have a buck amount called the deductible.

Paul B Insurance Medicare Agent Huntington for Beginners

You might have to pay $1,000 in medical expenses before your insurance policy kicks in. Strategies might cover some solutions without needing you to reach the insurance deductible, such as a certain webpage variety of sick visits and also well gos to. When you have actually fulfilled your deductible, the insurance firm will begin to share in the price of your clinical costs.

You could have a $10 copay every time you see your main treatment medical professional or $30 every time you see a professional. This amount remains the same no matter just how much the go to expenses. Coinsurance is the portion of the expense that you are accountable for. Say your coinsurance is 20%.

The insurance firm pays the rest. Many health strategies are needed to cover preventive treatment without any cost-sharing.

The Of Paul B Insurance Medicare Agent Huntington

You can discover a checklist of all the totally free preventative care services below. Some strategies that existed prior to 2010 that have actually not considerably altered-- known as grandfathered plans-- and also short-term health insurance plan those that provide coverage for less than a year-- do not have to supply free precautionary solutions.If you're having a heart assault or are bleeding terribly from an injury, telephone call 911 or go to hazard insurance the emergency room. You can always get treatment at an emergency clinic, regardless of what kind of insurance coverage you have-- but it may cost you greater than if you mosted likely to a physician's office or an immediate treatment clinic for therapy.

Spending for wellness care entails two types of costs. You pay a month-to-month premium and also your cost-sharing-- the section of each therapy or solution that is your duty. The amount of money you pay differs from strategy to strategy. Many health insurance plan have a dollar quantity called the deductible.

Some Known Incorrect Statements About Paul B Insurance Medicare Health Advantage Huntington

As an example, you may need to pay $1,000 in medical bills prior to your insurance coverage begins. Plans might cover some services without requiring you to reach the insurance deductible, such as a certain variety of sick visits and well visits. When you've met your deductible, the insurer will begin to cooperate the price of your clinical bills.You might have a $10 copay every time you see your key care doctor or $30 every time you see a professional. Coinsurance is the portion of the price that you're accountable for.

The insurance provider pays the rest. A lot of health insurance plan are called for to cover precautionary care with no cost-sharing. This indicates even if you have not satisfy your yearly deductible, you can still obtain precautionary treatment services totally free. Preventative treatment benefits consist of immunizations, some cancer screenings, cholesterol testing, and counseling to improve your diet regimen or stop cigarette smoking.

7 Simple Techniques For Paul B Insurance Medicare Agency Huntington

You can locate a listing of all the cost-free preventative treatment solutions right here. Some strategies that existed before 2010 that have actually not considerably changed-- called grandfathered plans-- and also short-term health insurance those that offer insurance coverage for much less than a year-- do not need to provide totally free precautionary services.Report this wiki page